NextGen Financial Services

Enablement Platform

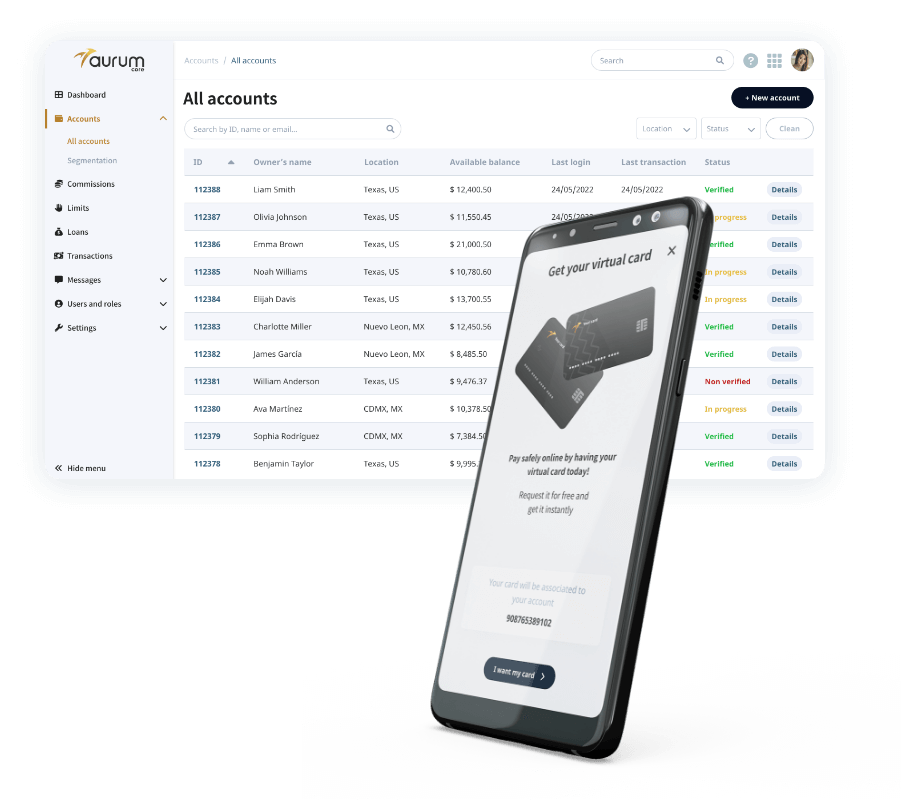

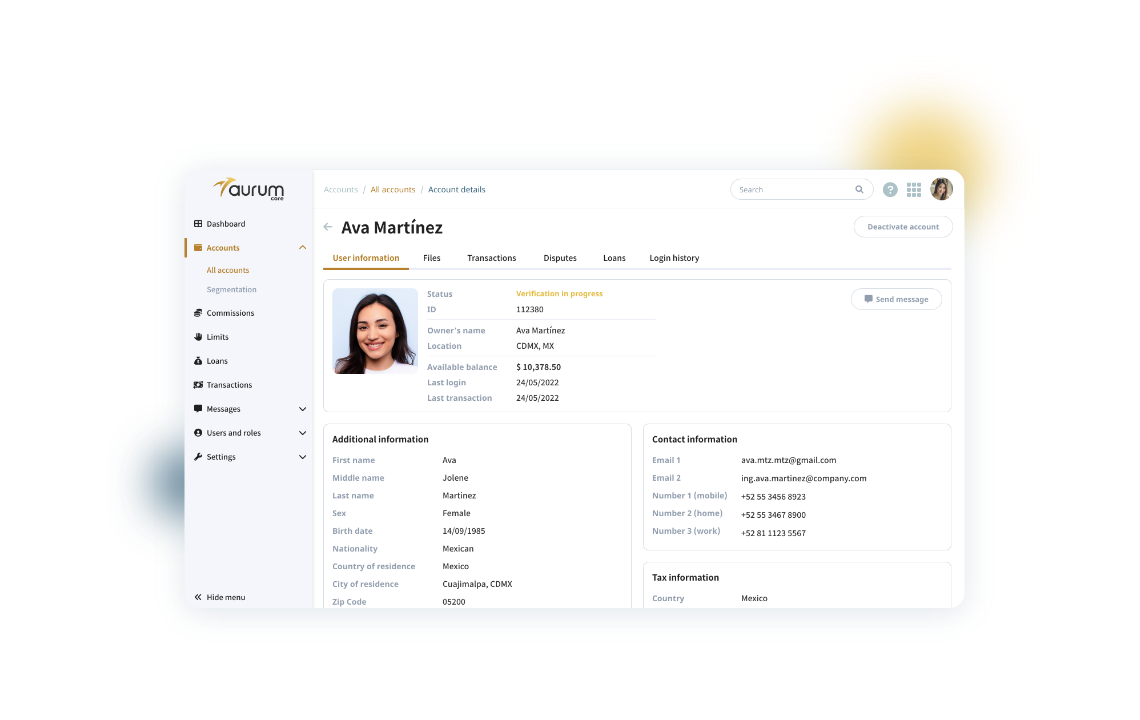

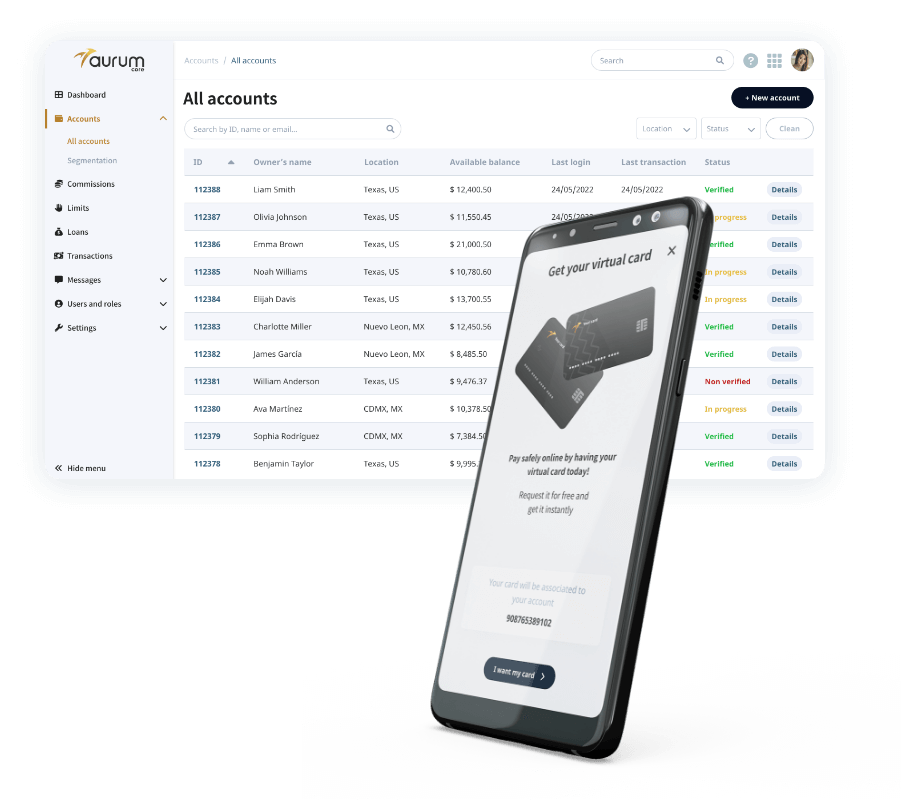

Installation and configuration of Aurumcore in weeks, as well as being highly customizable.

Aurumcore's architecture was designed 100% modular and based on APIs to easily integrate and/or develop the various components your use case requires.

Aurumcore complies with the requirements and controls of Mexican banking regulation and the Payment Card Industry.

Aurumcore operates on physical, virtual infrastructure, or any cloud, in addition to supporting high transaction volumes per second.

Yes

It includes the use of the platform and new product releases.

AurumCore can easily integrate practically any service or information source, so data integrations can be built according to the financial company's use case

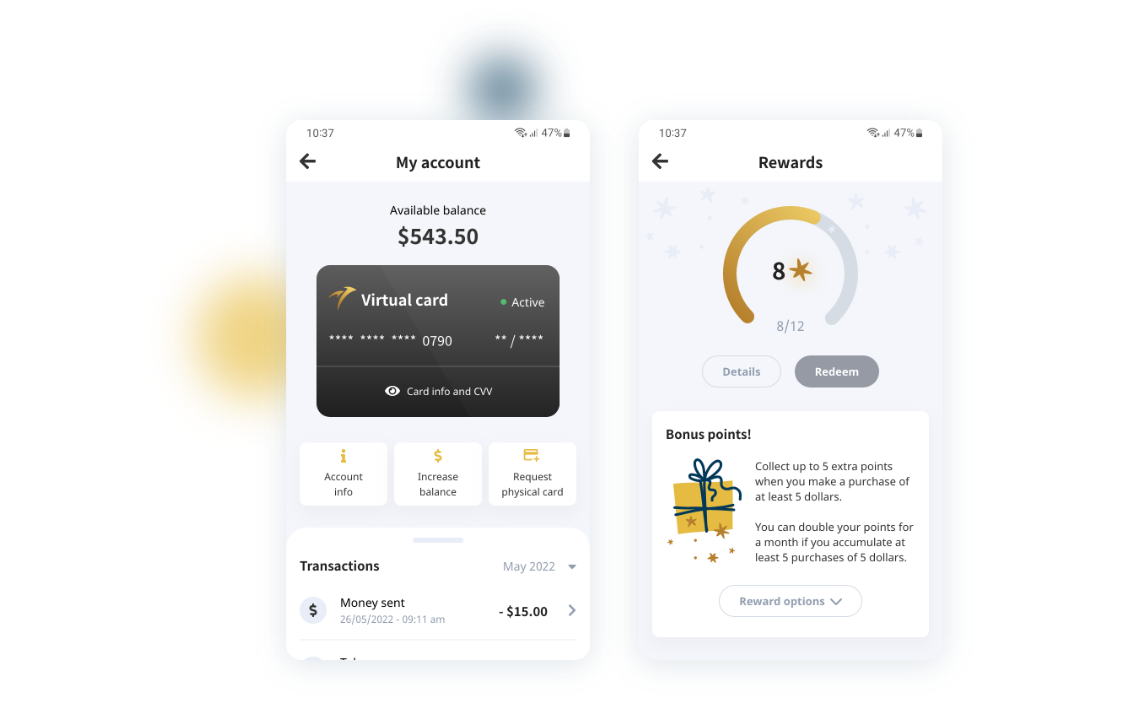

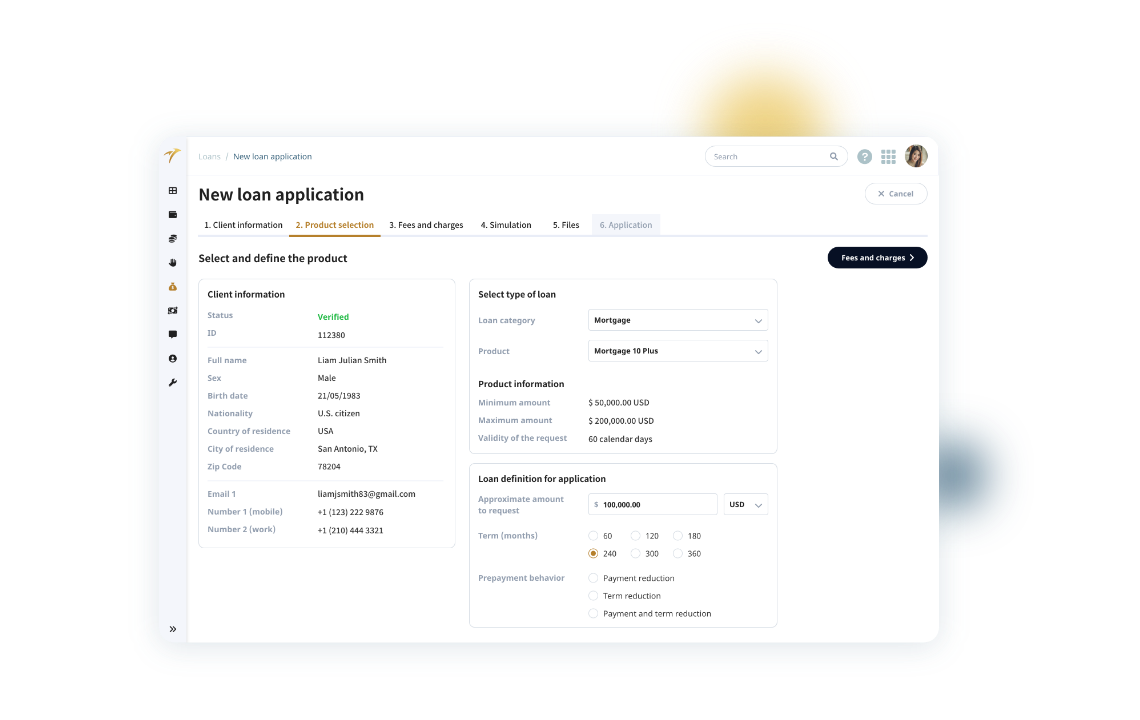

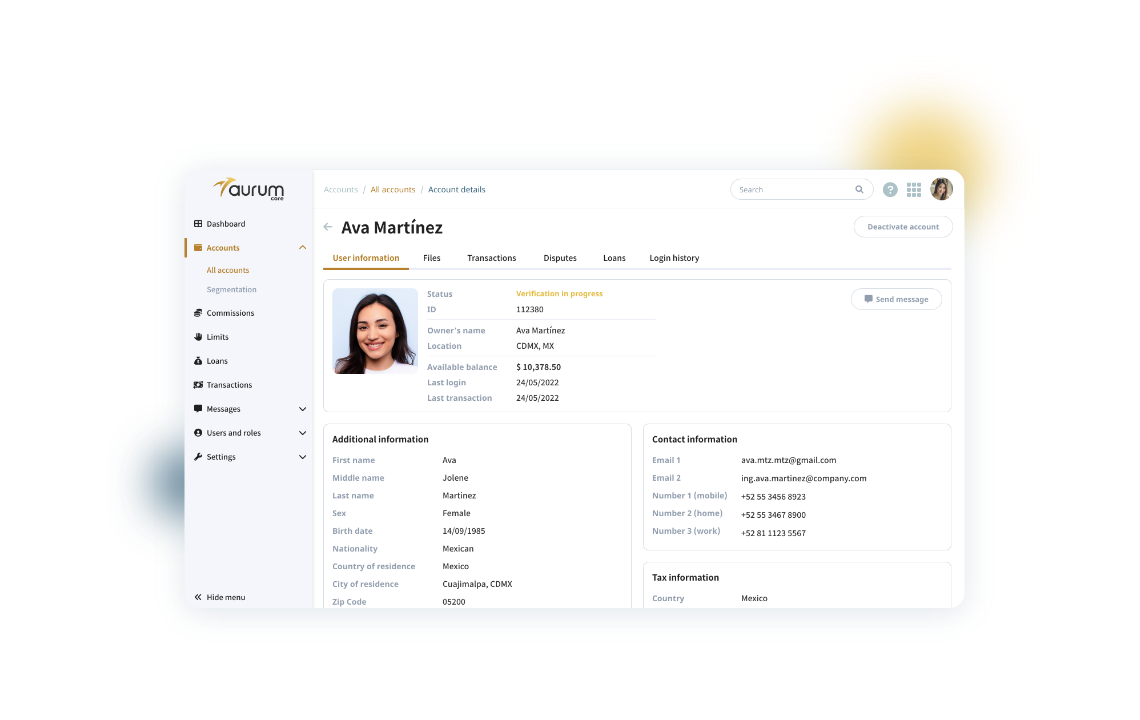

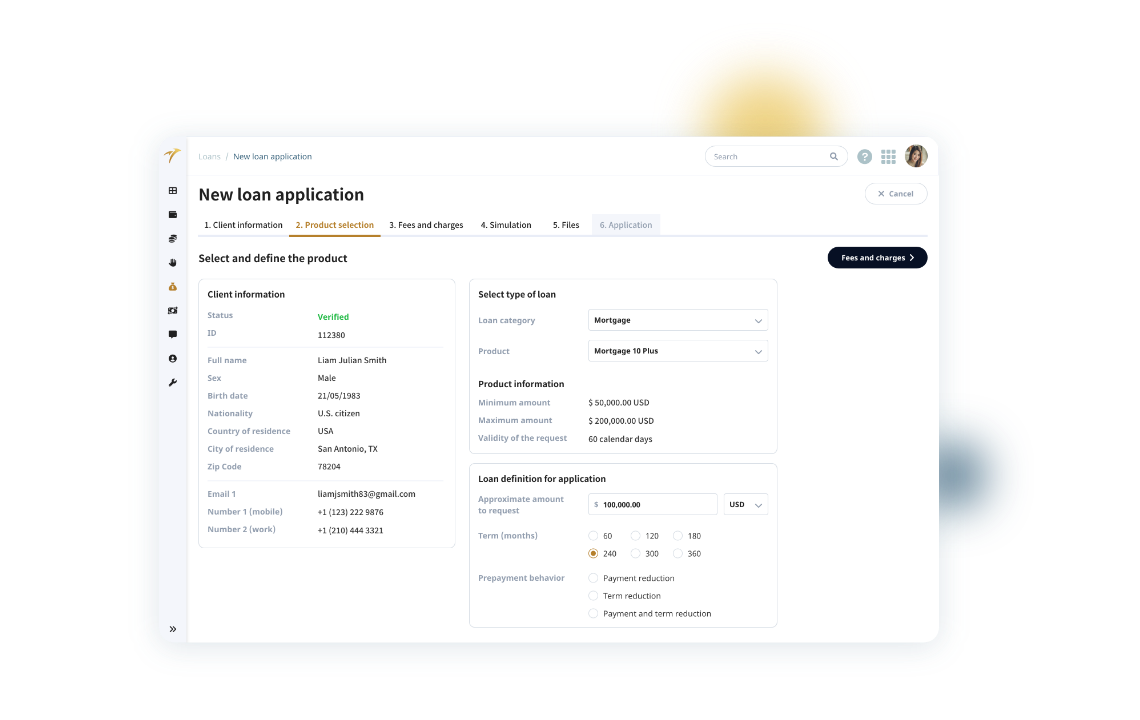

We make it easy to launch financial products, innovate in the process and power your financial institution. From 3 to 6 months depending on the type and quantity of services.

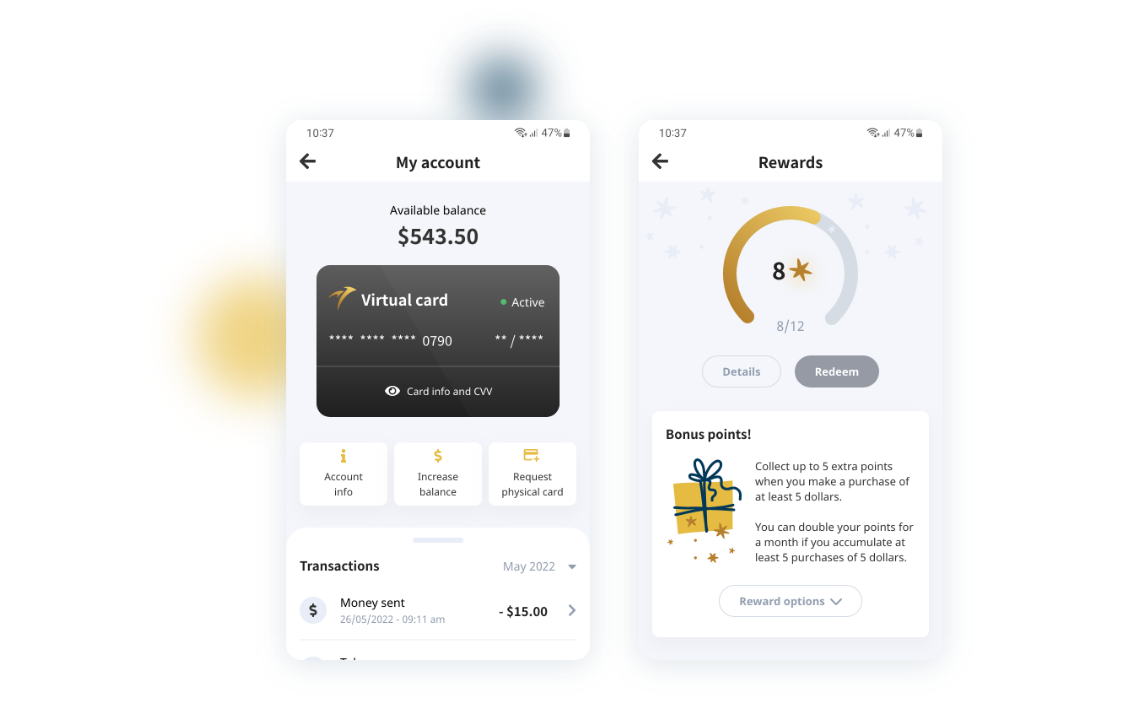

E-wallets, Crowdfunding, Lending, Business Loans, Payroll Loans, Personal loans, Cashback, Loyalty Points, Investment, Mobile Banking, Micro lending, Rewards program, On demand Accounts, Financial Lending, Mortgage loans.